I had IPL done on my face two weeks ago at the Mansfield location. All of the staff were so welcoming and nice! Angela and Amy are the two that interacted with the most. Both of them explained the procedure thoroughly and answered my questions very well. The facility is very clean and nice. I loved the results and will definitely recommend IPL at Paragon Plastic Surgery to my friends and family!

Google

I got their med spa membership and Angela has been doing my treatments for the last 3 months. She is very sweet and professional. My skin is starting to look amazing after years of neglect. Thanks Angela!

Google

“I recently had surgery performed by Dr. Bishara, and I can’t say enough good things about my experience. From start to finish, he was incredibly understanding and professional, putting me at ease during what could have been a stressful time. His staff was equally impressive—friendly, efficient, and attentive to every detail. The office itself has a calm, relaxing atmosphere, which made all the difference. I’d recommend Dr. Bishara and his team to anyone without hesitation!”

Google

I think I fell in love with my doctor. He is an amazing doctor. He cares about what I’m going through was with me throughout the whole process whether it was nighttime daytime he was there. I know he’s married, but if you’re seeing this doctor hit me up :-)

Google

I think I fell in love with my doctor. He is an amazing doctor. He cares about what I’m going through was with me throughout the whole process whether it was nighttime daytime he was there. I know he’s married, but if you’re seeing this doctor hit me up :-)

Google

Post-op checkup review: I am beyond grateful for the exceptional care and compassion Dr. Bishara and his team have shown me throughout my entire journey, especially post-op. His team has been incredibly supportive every step of the way.

After my procedure, the level of care has been outstanding. Dr. Bishara and his team are always available to address any concerns. They genuinely care about their patients’ well-being, and it shows in everything they do. I have felt truly supported, and it has made my recovery so much easier.

The results speak for themselves, but it’s the genuine kindness and compassion from everyone in the office that makes Dr. Bishara stand out. I can’t recommend him and his team enough! They go above and beyond to provide not just exceptional medical care but also an experience that feels personal and heartfelt. Thank you, Dr. Bishara and team, for making this journey so positive!

First review: My experience with Dr. Bishara and his incredible team at Paragon has been nothing short of outstanding! From the moment I walked in for my consultation to the actual procedure, everything went smoothly and exceeded my expectations. I had originally planned to go elsewhere for my mommy makeover, but after meeting Dr. Bishara, I knew I had made the right choice.

The staff at the office is amazing—so respectful, friendly, and genuinely dedicated to making you feel comfortable every step of the way. Chloe, Melanie, and everyone else on Dr. Bishara’s team are extremely professional and do their jobs with great care and attention to detail. Communication is clear, and I always felt informed throughout the process, which was such a relief.

The facility itself is top-notch—immaculately clean, cozy, and welcoming. The atmosphere is calm and inviting, which made every visit to the Mansfield location a pleasant experience. I always looked forward to my appointments, knowing I’d be taken care of by such a great team.

I also have to give a special shoutout to Marisol—she is hands down the best! Her warmth and helpfulness made each visit even more enjoyable. She’s incredibly friendly, attentive, and made me feel so at ease. I honestly had fun during all my visits with her!

Overall, my entire experience has been wonderful, and I’m already looking forward to future visits with Dr. Bishara and his amazing team. If you're considering any cosmetic procedures, I can't recommend them enough—thank you for making this experience so incredible!

Google

Post-op checkup review: I am beyond grateful for the exceptional care and compassion Dr. Bishara and his team have shown me throughout my entire journey, especially post-op. His team has been incredibly supportive every step of the way.

After my procedure, the level of care has been outstanding. Dr. Bishara and his team are always available to address any concerns. They genuinely care about their patients’ well-being, and it shows in everything they do. I have felt truly supported, and it has made my recovery so much easier.

The results speak for themselves, but it’s the genuine kindness and compassion from everyone in the office that makes Dr. Bishara stand out. I can’t recommend him and his team enough! They go above and beyond to provide not just exceptional medical care but also an experience that feels personal and heartfelt. Thank you, Dr. Bishara and team, for making this journey so positive!

First review: My experience with Dr. Bishara and his incredible team at Paragon has been nothing short of outstanding! From the moment I walked in for my consultation to the actual procedure, everything went smoothly and exceeded my expectations. I had originally planned to go elsewhere for my mommy makeover, but after meeting Dr. Bishara, I knew I had made the right choice.

The staff at the office is amazing—so respectful, friendly, and genuinely dedicated to making you feel comfortable every step of the way. Chloe, Melanie, and everyone else on Dr. Bishara’s team are extremely professional and do their jobs with great care and attention to detail. Communication is clear, and I always felt informed throughout the process, which was such a relief.

The facility itself is top-notch—immaculately clean, cozy, and welcoming. The atmosphere is calm and inviting, which made every visit to the Mansfield location a pleasant experience. I always looked forward to my appointments, knowing I’d be taken care of by such a great team.

I also have to give a special shoutout to Marisol—she is hands down the best! Her warmth and helpfulness made each visit even more enjoyable. She’s incredibly friendly, attentive, and made me feel so at ease. I honestly had fun during all my visits with her!

Overall, my entire experience has been wonderful, and I’m already looking forward to future visits with Dr. Bishara and his amazing team. If you're considering any cosmetic procedures, I can't recommend them enough—thank you for making this experience so incredible!

Google

If I could I would legitimately marry this facility. Everyone is so kind the doctor is knowledgeable and makes everything feel comfortable. Marisol was the sweetest and helped my anxiety I spoke to several other places and did consults and I’m glad I waited until I found the perfect place. 100% recommend. Thank you so much for being so kind and helping me achieve what I wanted to feel like a better me.

Google

If you want results, see Dr. Bishara for all injections. ????

Google

If you want results, see Dr. Bishara for all injections. ????

Google

(Late post) - Dr. Bishara and his team exceeded my expectations! They made me feel very comfortable through the entire process, VERY satisfied with the results! Highly recommend!

Google

(Late post) - Dr. Bishara and his team exceeded my expectations! They made me feel very comfortable through the entire process, VERY satisfied with the results! Highly recommend!

Google

Dr. Bishara and his staff are so amazing and very welcoming! As for my journey, Melanie has been so patient and understanding through this whole process! I can’t thank her enough! Can’t wait for my soon to be results!!

Google

Dr. Bishara and his staff are so amazing and very welcoming! As for my journey, Melanie has been so patient and understanding through this whole process! I can’t thank her enough! Can’t wait for my soon to be results!!

Google

Dr. Bishara and his staff are amazing!! I would highly recommend. I have such a cute bellybutton now!!! I will be checking out some of the spa services since I had such an amazing experience with the other side of the clinic.

Google

Dr. Bishara and his staff are amazing!! I would highly recommend. I have such a cute bellybutton now!!! I will be checking out some of the spa services since I had such an amazing experience with the other side of the clinic.

Google

I had my old (bad) eyebrow microblading lasered off by Britt and am so thankful for the amazing care I received. Britt is an expert in her field and there’s no one else I’d trust. 5 stars all the way for Britt and Paragon!

Google

I had my old (bad) eyebrow microblading lasered off by Britt and am so thankful for the amazing care I received. Britt is an expert in her field and there’s no one else I’d trust. 5 stars all the way for Britt and Paragon!

Google

Dr Bishara and staff can be trusted with their various procedures. He takes time to explain the process as well as recovery time and what to expect at every step. Excellent end product ????????

Google

Dr Bishara and staff can be trusted with their various procedures. He takes time to explain the process as well as recovery time and what to expect at every step. Excellent end product ????????

Google

I had abdominal liposuction a year ago w/Dr. Bishara. He told me I had a hernia which I didn’t know about, and that he could remove/fix it with a tummy tuck. He cautioned that liposuction likely wouldn’t give me the full results I was wanting, but I was initially nervous about tummy tuck surgery. A year later, October 20, I had the tummy tuck and hernia removal. I’m still in the process of recovering, but it was a lot easier recovery than I expected.

Dr. Bishara is AMAZING! No matter the concern, he’ll make time to see me, and he’s incredibly easy to talk to. He takes the time to fully explain the procedure, and answer any questions I have. I visited several plastic surgeons before doing my first procedure, the liposuction, and I will NEVER see any other surgeon. I look forward to my appointments and definitely have more I plan on doing. Additionally his staff is FANTASTIC! They’re so friendly, and make a sometimes awkward situation (naked photos, etc..????) as easy as possible.

If you’re considering plastic surgery, I could not recommend Dr. Bishara highly enough, well above 5 stars!

Google

So thankful I found this office for my breast augmentation/lift, I am so pleased with how they took care of me for my surgery, the whole process has been so nice since day 1 of my consult/preop appt/actual surgery day they have been the nicest most comforting staff I’ve ever come across at a medical office. HIGHLY RECOMMEND this beautiful office ????❤️

Google

The staff is outstanding and the Doc is engaging, attentive, and provides down to earth explanations. He takes the time with each patient and ensures all your questions answered. Last, the facilities are first rate, calming, and comfortable.

Google

tengo 10 años conociendo al doctor Mark Bishara, el durante estos 10 años ha sido mi cirujano plástico ha sido mi mentor ha sido un gran y excelente amigo compañero pero sobre todo es un gran médico es un gran cirujano ya que sus manos están bendecidas por Dios y hace unos trabajos súper excelentes, dos veces e estado en manos para mis cirugías y me puesto mis bellos implantes que se miran súper naturales , a trabajado conmigo en dos tummy tuck y ahora a dado forma espectacular y natural a mi cuerpo tiene una experiencia impresionante y sobre todo sus trabajos son los mejores de Estados Unidos si piensas hacerte una cirugía cosmética no busques mas el Doctor Mark Bishara es uno de los mejores en ???????? y con todo su equipo laboral por que sus enfermeras y asistente tienen también la capacidad de poder ayudarte están a la la altura Gracias por dejarme más hermosa y lo recomiendo 100????por ciento ???????????????? Obviamwnte seguiré en sus manos Gracias a mi querido Doctor Mark Bishara y a todo su equipo por tan bellas atenciones. Gracias

Google

Angela is amazing! I have been coming to paragon for 12 years and have seen Angela for 7. She is dependable, professional, and excellent and what she does. My skin has never looked better.

Google

Paragon is the best med spa that I have been to hands down! Angela has been providing my services for Hydrofacials, Ultherapy, Morpheus 8 and a few others for over 5 years now and you cannot find a better qualified medical esthetician out there. She is the absolute best at what she does - so detailed and dedicated to providing you with amazing results. If you are the gal or guy thinking about taking your look to the next level and making that self-care pact with yourself - go see her!!!

Google

Nos encanta venir con el Dr. Mark A. BiShara! Son muy profesionales, una de las cosas que me súper encanta es que son muy atentos, se aseguran que te sientas bien y segura. Nos explican el procedimiento y que tenemos que esperar es algo que me encanta de ellos.

Google

Had my hair done now over 8 months later WOW! ???? Dr is great! He's really good at what he does! My wife is going here also for other procedures! Your in good /Great! Hands!

Danny

Google

My first visit to Dr. B was in the Southlake office. The location was easy to find and the staff very kind and attentive. Luckily, I found his other office which was closer to where I live. If I ever need an appointment on the spot it is definitely worth the trip to drive up to Southlake and see the best plastic surgeon in the business. Thank you for everything you have done for me!

Google

I’ve been seeing Dr. Bishara and his staff for years. They are outstanding at what they do and extremely helpful and caring. I highly recommend Paragon Plastic Surgery.

Google

Love Angela, she is amazing!

Google

I have visited Paragon Medspa three times now and they are wonderful! Angela is definitely who you need to ask for for any laser or facial procedures! She is awesome! Dr. Bishara is also amazing for injections and fillers! They both have a great bedside manner and take the time to answer all of your questions so that you’re completely comfortable during your appointment. I won’t be going anywhere other Paragon med spa!????

Google

Best place ever! will make you feel forever21????

Google

By far one of the most professional and knowledgeable med spas in the US. Britt is the absolute best. She’s taught me so much about my skin care routine, and about my sun damage which says a lot especially since I know absolutely nothing about skin care. Britt made me feel completely comfortable and explained everything to me in great detail. There will be no leathery wrinkles for this girl thanks to the expertise and staff of paragon plastic surgery and med spa. 100 out of 10 recommend.

Google

I have been going to them for about 6 months now and I am hooked! ???? I absolutely love my facials with Britt! ???? She’s the best!! Paragon is highly recommend ????

Google

Very clean, professional and informative. Britt is very informative with great patience and nice. She was in NO rush and walks through each step by step. I felt during and when leaving very comfortable with her and my complete visit. I DEFINITELY recommend this clinic. Thanks Britt????

Google

One of the BEST spa I’ve been to! Highly recommend it.

I signed up for a monthly membership, which offers the best deals I’ve seen ????????

Google

Great doctor, great staff! Better result than I expected and very affordable. My cousin used Dr. Bishara, so that was the best advertisement!

Being 60 has it’s challenges, I’ve been told I look 12 years younger....it was so painless, too!????

Google

Love Dr Bishara! He keeps our best secrets and makes us feel young again... miracle man...???? staff is amazing !

Google

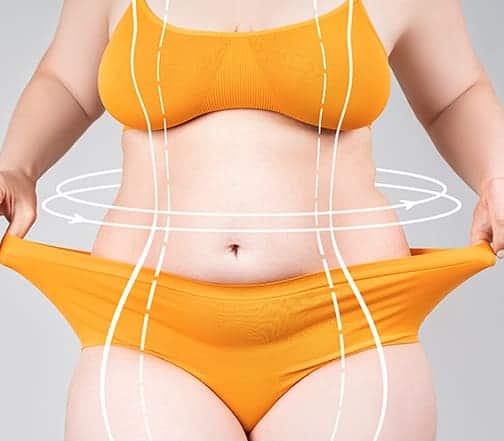

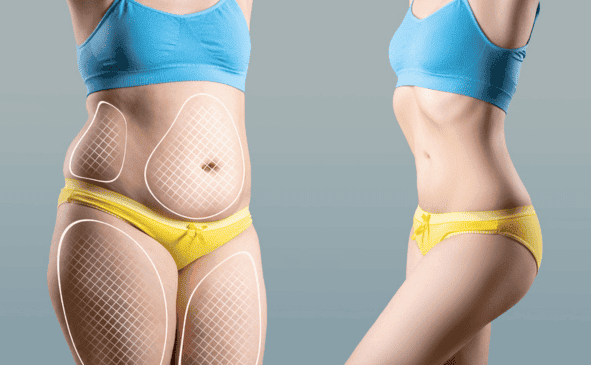

Body Contouring

Body Contouring

Tummy Tucks

Tummy Tucks

Mommy Makeovers

Mommy Makeovers

Liposuction

Liposuction

Breast Lifts

Breast Lifts

Breast

Reductions

Breast

Reductions

Face Lifts

Face Lifts

Brow Lifts

Brow Lifts

Eyelid Lifts

Eyelid Lifts

Cheek & Chin

Implants

Cheek & Chin

Implants

Hair

Restoration

Hair

Restoration

More

More

Book Appointment

Book Appointment

817-473-2120

817-473-2120

Balancing Breast

Size

Balancing Breast

Size